Are you tired of thinking about where to invest money? Do you wonder about investing in buying a property? Well, there are many other options to invest your money, but why invest in property? It’s an interesting question, but you can get the answer, and you will learn how beneficial it comes out to invest your savings in buying land.

You have to learn that investing your money means spending all your savings from the start. So you have to be careful and sharp. There is a need to make a mind and decide whether it is necessary for you or not. It’s a behalf that you can spend money on useless things unless you invest them.

Yes, it’s right to waste, count and save but invest them in buying a property. You must be thinking.

Why invest in property?

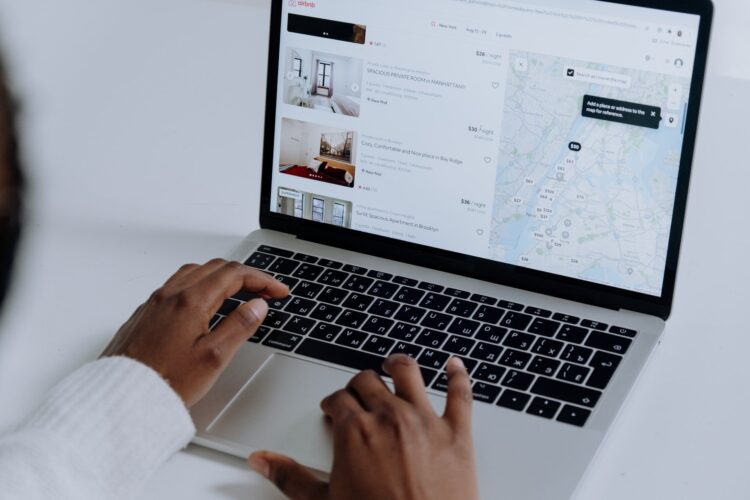

Because the population is running very fast and global warming continuously affects the lands. Play save and buy yourself a home, whether for yourself or your family. You can know easily found properties by searching online. Houzeo.com is a website where you can easily find yourself a peaceful home in Kentucky land for sale by owner or many other places. Let’s start the process of investing.

Do you afford to invest in property?

Deciding to invest, you must know whether you can afford this investment or not. Kindly measure your monthly income and all your expenditure because it’s good to calculate this entire first and then move on to invest. Suppose you done the incest but can further you can’t manage your savings.

Right, do the proper calculation before the investment, and then decide. And if you have a mortgage, you have to find out how much deposit you can put down. Some lenders acquire 25% from property value, but others can adjust between 15% deposit. Choosing a mortgage is quite a risky process.

Risk of investing in property

Learning only about the benefits isn’t fair. So take a deep breath and learn about some risks of investing in property. The main risk is that the housing market continuously changes. The pricing can be high or low. It depends upon the timing of the house sale.

The rental demands can also fluctuate. If you invest in property, then make sure to have a long-term investment. The goal that you can ride out all the storms and can easily sell when the market is good again. You might feel some financial disturbance when the market dips, so don’t take any stress related to your investment.

1) Find a portal to invest

It isn’t easy to choose whether you can trust and invest your money. As you know, there are many scams around looking to catch all the money of others and leave them empty-handed. To avoid this kind of situation, you have to be intelligent to pick one of the trustworthy websites for investments.

Some local sites are wrong so protect yourself from them. Visit the home selling portals like houzeo, redfin because you want to buy a property in your preferred area. They have unique and reliable homes for customers.

As for confirmation and better understanding, you must read the reviews of every website and know how it benefits you if you choose them. If you are not that free and don’t have enough time, you can hire an agent that can advise and help you find the best investing portal.

Online portals have a property in various places like you can choose it on commercial property directly or invest in real estate investment trustees. It is the most common type of investment. Remember that investing in trustees can be rewarding or risky.

The UK society like Kentucky prefers this method. They are other indirect property investments like other companies. Buying a property can cost solicitor fees, estate agency fees, Land Registry fees, surveys, mortgage fees, Stamp Duty, and setting up insurance.

These all expenses can come up when investing in property. As you read above, it’s risky because it can drain your money and return it. Don’t stretch yourself that much if something goes wrong. You can choose an alternative like shares, bonds, pooled funds, pensions, etc. but make sure you are on the right path.

2) Selecting a property

Once you find out which site you invest in, research to get yourself a home, your property must be based on your choice. Select the one property which pleases you to spend the rest of your time. Potential tenants and areas are no one priority when finding a property.

Your location matters whenever you buy a property, and the prices can also change according to the areas.

If you want a property in school areas, choose a good transport links property. Long-term plans always work out for the residential area. Run up to the agent because this time, you need a professional to help find a property. An agent knows all the details about the neighborhood and local areas’ prices.

3) Accept the offer

The offer for your selected house comes from the seller. The seller provides the price according to the place. But act wisely, negotiate the price, and try to agree on the seller according to your budget. Some sellers offer an excessive price which is not worth it. In this case, leave the situation and go for a potential seller. The lowest profitable price is suitable. Select a property that has no renovation and requirements to be done.

4) Complete the sale

All the things are done; now it’s time to jump to complete the sale. Add all the details of yours and your purchasing details. The billing method and all the billing documents are attached to complete the sale process. Do a little bit of inspection about your property. Make all your worries gone and check to complete the whole detailing of the house. Move on to exchange all the contracts with sellers.

Bottom line

Investing in a property is a great idea to save your money. It becomes easy if you read all the above details. Be determined before investing, so it becomes beneficial.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024