The world of artists and creatives is often marked by a blend of passion, unpredictability, and diverse income streams. While the freedom of artistic expression is a significant draw, it poses unique financial challenges. Balancing creativity with practicality is not just about honing your craft; it’s also about managing your finances smartly to ensure long-term stability and success.

This article will delve into essential financial tips tailored for artists and creatives. We will explore how to effectively budget, save, and invest, focusing on the unique needs of those with irregular incomes.

Additionally, we will introduce the paystub generator as a vital tool for managing and documenting diverse income sources, simplifying financial organization, and enhancing credibility when reporting income.

Understanding the Unique Financial Challenges for Artists and Creatives

Artists and creatives often face a financial landscape that’s vastly different from traditional 9-to-5 professionals. This section will unpack these unique challenges, providing insights into why conventional financial advice may not always apply and highlighting the necessity of tailored financial strategies.

1. Overview of the Financial Landscape for Creative Professionals

- The nature of work in creative fields is often project-based, leading to fluctuations in income.

- Many artists juggle multiple roles – from freelancing to running their businesses, each with distinct financial implications.

2. Common Challenges ─ Irregular Income, Multiple Income Sources, Project-Based Earnings

- Irregular income streams make it challenging to predict monthly earnings, complicating budgeting and planning.

- Managing multiple income sources, such as sales, commissions, grants, and freelance work, requires meticulous organization and tracking.

3. Importance of Financial Planning and Management in a Creative Career

- Understanding the cyclical nature of creative work and planning for lean periods.

- The role of financial planning in reducing stress and allowing artists to focus more on their creative pursuits.

This section provides a foundational understanding of the financial environment in which artists and creatives operate. It underscores the need for specialized financial strategies to navigate these challenges effectively.

Budgeting Strategies for Irregular Income

For artists and creatives, who often face fluctuating incomes, budgeting is not just a financial task but a critical tool for sustaining their creative pursuits. This section offers practical advice on how to create a budget that accommodates the unique financial rhythm of creative professions.

1. Techniques for Creating a Flexible Budget

- The concept of a flexible budget ─ Adjusting your budget monthly based on expected income and expenses.

- How to estimate your average monthly income by analyzing past earnings, and considering seasonal trends in your field.

- Allocating funds to necessities, savings, and discretionary spending in a way that reflects your fluctuating income.

2. Tips for Managing Fluctuating Income and Expenses

- Strategies for smoothing out income ─ Setting aside a portion of higher-earning months to cover lower-earning periods.

- Identifying and reducing variable expenses during leaner months.

- The significance of revisiting and adjusting your budget regularly to align with your income patterns.

3. Role of the Paystub Generator in Tracking and Organizing Income from Various Sources

- How a paystub generator can simplify the tracking of income from diverse sources, such as gallery sales, freelance projects, and teaching gigs.

- Utilizing paystub generators to provide a clear, organized record of income, is crucial for tax purposes and financial planning.

- Enhancing the credibility of your financial records is particularly useful when applying for loans, grants, or residencies.

By embracing these budgeting strategies, artists and creatives can better manage their finances, ensuring stability even in the face of irregular income. This section not only offers practical advice but also highlights the use of a paystub generator as a key tool in achieving financial organization.

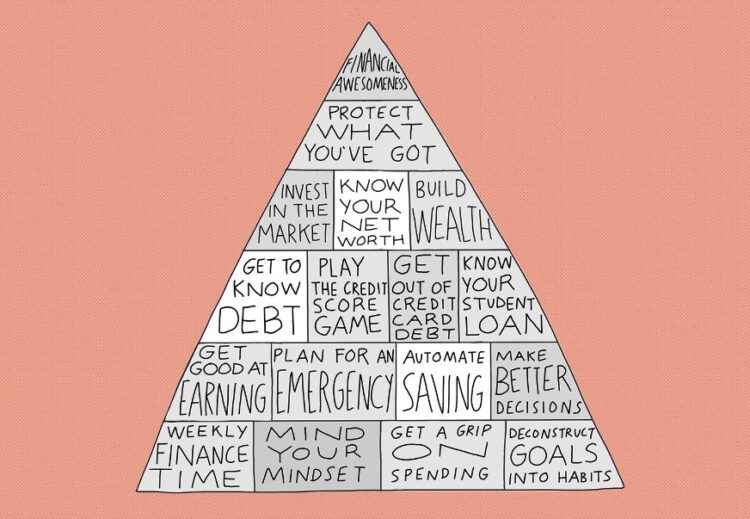

Saving and Investing as a Creative Professional

Artists and creatives, with their unique income structures, must approach saving and investing with strategies that cater to their specific financial circumstances. This section delves into practical methods to build financial security and invest in the future, ensuring that creatives can continue to pursue their passions without financial constraints.

1. Importance of Building an Emergency Fund

- The critical role of an emergency fund is to provide a financial safety net for periods of low income or unexpected expenses.

- Guidelines on how much to save and strategies to build this fund, even with irregular income.

- Tips on where to keep your emergency fund for easy access and optimal growth.

2. Investment Strategies Tailored to the Risk Tolerance and Financial Goals of Creatives

- Understanding personal risk tolerance and how it influences investment choices.

- Diversifying income through investments, such as stocks, bonds, or real estate, is suitable for long-term financial goals.

- Exploring creative industry-specific investment opportunities, like crowdfunding platforms for artists or investing in creative tools and education.

3. How Savings Can Fuel Future Creative Projects and Endeavors

- The concept of reinvesting savings into your art, such as funding personal projects, upgrading equipment, or expanding your skillset.

- Balancing between saving for personal financial security and investing in your creative career.

- Case examples of how strategic savings and investments have helped creatives achieve major career milestones.

This section emphasizes the importance of an emergency fund, offers tailored investment advice, and highlights the beneficial cycle of saving and reinvesting in one’s creative career. Understanding these concepts is crucial for artists and creatives to achieve both financial stability and artistic growth.

In the final section, Section 4, we will provide a comprehensive overview of the paystub generator tool, illustrating its utility in financial organization and enhancing credibility in income reporting for artists and creatives.

The Paystub Generator ─ A Tool for Financial Organization and Credibility

In the diverse and often complex financial world of artists and creatives, the paystub generator emerges as a powerful tool for managing and documenting income. This section offers a detailed exploration of how this tool can enhance financial organization and credibility, especially for those with multiple income streams.

1. Detailed Overview of How a Paystub Generator Works and Its Benefits

- Explanation of what a paystub generator is and how it operates ─ a digital tool to create professional paystubs based on income data entered by the user.

- The benefits of using a paystub generator, such as accuracy in income reporting, time-saving in financial record-keeping, and ease of use.

2. Case Studies or Examples of How Artists and Creatives Have Utilized This Tool

- Real-world scenarios where artists and freelancers have successfully used paystub generators to streamline their financial management.

- How these tools have aided in loan applications, grant submissions, and income verification processes for creative projects.

- Testimonials or quotes from professionals in the creative industry about their experiences with paystub generators.

3. Tips on Choosing the Right Paystub Generator and Integrating It into Financial Management Practices

- Key features to look for in a paystub generator ─ ease of use, customization options, modern pay stub templates, compatibility with other financial tools, and security.

- Steps to integrate a paystub generator into regular financial practices, such as syncing it with accounting software or using it alongside budgeting tools.

- Best practices for maintaining and organizing digital financial records created with a paystub generator.

By incorporating a paystub generator into their financial toolkit, artists and creatives can gain a clearer understanding of their income patterns, make more informed financial decisions, and present a professional image when reporting income. This tool not only simplifies financial management but also adds a layer of credibility to the diverse income streams characteristic of creative professions.

The financial journey of an artist or creative is unique, blending the unpredictability of artistic income with the need for financial stability. Through this article, we’ve explored practical strategies for budgeting, saving, and investing that are tailored to the financial realities of creative professionals. Additionally, we’ve highlighted the invaluable role of the paystub generator in organizing and legitimizing diverse income sources.

By embracing these tools and strategies, artists and creatives can navigate their financial landscapes with greater confidence and security, allowing them to focus on what they do best: creating and inspiring.

Navigating Financial Stability in the Creative Arena

The journey of an artist or creative professional is inherently marked by a blend of passion, unpredictability, and diverse income streams. This unique path requires a distinct approach to financial management – one that balances the fluid nature of creative work with the practicalities of financial stability.

Through this comprehensive guide, we have traversed various facets of financial planning specifically tailored for the artistic and creative community.

From understanding the unique financial challenges that creatives face to adopting flexible budgeting strategies that cater to irregular income, we’ve laid out a roadmap for financial management that respects the nuances of creative professions. The importance of saving and investing was underscored, highlighting how a strategic approach to finances can not only provide a safety net but also fuel future artistic endeavors.

A key takeaway from this exploration is the significant role of technological tools like the paystub generator in simplifying financial processes. These tools not only aid in organizing and documenting diverse income sources but also enhance credibility when reporting income.

They represent a fusion of creativity and practicality, offering a streamlined approach to managing the complex financial landscape of artists and creatives.

As creatives continue to navigate their unique paths, integrating these financial strategies and tools will be pivotal. Balancing creativity with practicality is not just about financial survival; it’s about thriving. By equipping themselves with the right financial knowledge and tools, artists and creatives can ensure that their financial foundation is as robust as their creative output.

In conclusion, this article aims to empower the creative community with the knowledge and resources necessary to navigate their financial journey with confidence. By embracing these strategies, artists and creatives can continue to inspire and innovate, secure in the knowledge that their financial well-being is taken care of, allowing them to focus on what truly matters – their art.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024