Choosing the right area is everything in real estate. Malta offers several regions that attract consistent interest from investors who want solid returns. Some neighborhoods perform better than others. You need to pick based on long-term value, not short-term hype.

Whether you’re buying to rent or planning for resale, location in Malta matters more than ever.

Key Highlights

- Sliema and St. Julian’s remain dominant for rental yield and resale value.

- Gozo presents affordable opportunities with growth potential.

- Central Malta offers strong returns with less volatility.

- Southern Malta is growing, offering value-focused investments.

- The north is becoming popular with remote workers and retirees.

- Stability in Malta’s property market supports long-term investment security.

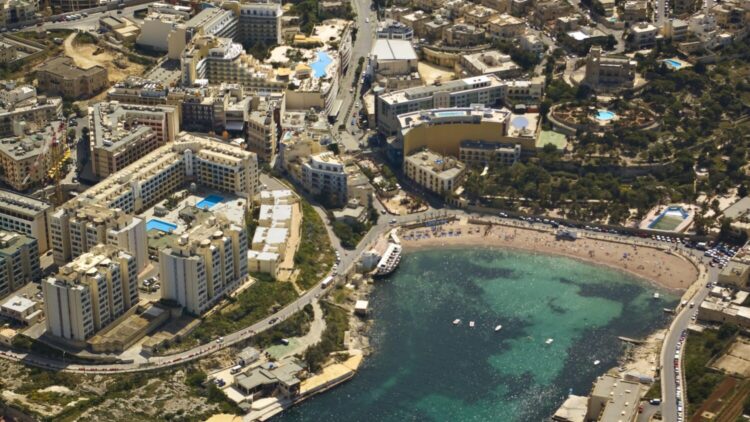

Sliema and St. Julian’s: Prime Coastal Powerhouses

Sliema and St. Julian’s top the list for a reason. These towns are packed with demand. Long-term tenants include professionals, expats, digital nomads, and wealthy locals.

Properties here don’t stay vacant for long. High-rise apartments with sea views fetch strong monthly rents. Yields in certain blocks push above 5%. Capital appreciation stays steady.

You pay a premium here, but you get access to infrastructure, cafes, business districts, and schools. Sliema also has strong resale liquidity—owners find buyers quickly even when the market cools.

You won’t find many cheap deals in these areas. But if you want consistent rental income and resale value, few places compete.

Gozo: A Rising Alternative with Hidden Value

Gozo is Malta’s quieter, greener sister island. Property prices are lower, and that alone draws investor attention. The tourism pull is strong, but so is the demand for long-term rentals from remote workers and retirees.

If you’re looking for more relaxed markets, take a look at property for sale in Gozo. Prices remain lower than mainland Malta, which makes entry easier. Farmhouses, townhouses, and modern apartments all have appeal.

Unlike Sliema, Gozo offers space and scenery. It’s slower, but that’s exactly why it’s attractive to a growing base of tenants. Expect yields of 3–4% on most residential rentals, with long-term appreciation driven by infrastructure upgrades and increased ferry access.

Central Malta: Balanced Growth and Strong Demand

Areas like Birkirkara, Mosta, Attard, and Balzan sit in the heart of Malta. They’re not coastal, but they’re connected. You get schools, shopping centers, public transport, and everyday amenities. These towns serve Maltese families and working professionals.

Prices are stable. Demand remains strong. And because you’re not paying coastal premiums, your rental yields can actually outperform more glamorous addresses.

You won’t find luxury towers here. Instead, think townhouses, maisonettes, and new apartments that rent well year-round. With consistent interest and a local tenant base, central Malta offers predictability.

It’s also ideal for investors who want to avoid tourist season swings.

Southern Malta: Value-Packed Growth Zones

Southern towns like Marsascala, Zabbar, and Birzebbuga have seen serious development in recent years. They offer better value per square meter than the north or central districts.

Rental demand is increasing thanks to better transport links and affordable housing. Investors are looking closely at the south because it hasn’t hit the same pricing ceiling as Sliema or Valletta.

Marsascala, in particular, draws attention with its seafront promenade and expanding dining scene. Buyers can still find three-bedroom properties under €300,000—something almost unheard of in more established zones.

Returns here depend on patience. You won’t get overnight appreciation, but the long-term curve is moving in the right direction.

The North: Lifestyle Appeal with Investment Upside

Qawra, Bugibba, and Mellieha are positioned in northern Malta, known for open spaces and scenic coastline. These areas have become increasingly attractive to remote workers, retirees, and international buyers.

Mellieha, for instance, combines modern living with natural beauty. It’s quieter than St. Julian’s but still close enough to feel connected.

Tourism supports short-let potential, but long-term tenants are growing thanks to telecommuting trends and lifestyle migration. Developments in the north now include schools, medical centers, and improved roads.

Prices vary, but demand keeps climbing. Investors who focus on well-positioned apartments with parking and views are seeing long-term gains.

Buy-to-Let vs Capital Growth: What’s Your Priority?

Different regions in Malta support different strategies. Investors need to decide if rental income or capital appreciation drives their goal.

Best for Rental Yield:

- Sliema

- St. Julian’s

- Central Malta (Birkirkara, Mosta)

Best for Future Growth:

- Gozo

- Southern Malta

- Northern Malta (Mellieha, Qawra)

Timing matters. So does the type of tenant you attract. Students? Retirees? Corporate expats? Each area speaks to a different profile, and choosing the wrong zone can stall your returns.

Regulatory Considerations for Long-Term Investors

Long-term property investment in Malta must align with legal regulations. Foreign nationals can buy property in Malta, but restrictions apply depending on residency status and the type of property.

Check:

- Acquisition of Immovable Property (AIP) permits

- Residency eligibility if you plan to stay in Malta

- Tax implications on rental income

Malta has several tax incentives for foreign investors, but rules can shift. Always consult a property lawyer or licensed estate agent familiar with the region you plan to invest in.

Market Data: Property Trends You Should Track

Long-term investors must track Malta’s real estate data. Prices remain resilient, even with global inflation and shifting tourism trends.

According to the National Statistics Office of Malta:

- Average property prices have risen by 7–9% annually since 2017.

- Rental prices are up by an average of 4.5% year-on-year.

- Gozo and southern Malta have seen the sharpest increases in sales volume.

Smart investors use data to time purchases. Avoid rushing into areas just because they appear trendy. Follow volume, not just marketing.

Conclusion: Pick the Zone, Then Pick the Property

Malta is a small island, but its property markets are very different from one region to the next.

Long-term property investment success depends on the area you choose.

High-priced towns like Sliema are safe bets for steady income. Affordable regions like Gozo offer growth potential. Central areas bring balance.

The north and south promise future value—but only for patient investors.

Know your goals. Then pick a location that matches.

Success in Maltese real estate depends less on the building—and more on the ground it stands on.

Hi Boox Popular Magazine 2025

Hi Boox Popular Magazine 2025