Navigating the world of real estate can often feel like a maze of legalities and technicalities. Yet, two services stand out as invaluable aids in this process: conveyancing and survey services. These services unravel the complexity of the property market, ensuring that property buyers and sellers can sail through the process seamlessly and with confidence.

In the realm of real estate, conveyancing and survey services are crucial. They play instrumental roles in transactions, ensuring that all legal requirements are in order, potential problems are identified, and the property’s value is accurately determined. This introduction will give you a brief overview of these services and highlight their importance in the ever-evolving real estate industry.

Conveyancing involves the legal transfer of property ownership from one party to another. It is a process steeped in legal intricacies, ensuring that all the i’s are dotted and t’s are crossed. On the other hand, survey services assess a property’s condition, checking things like soil structure, vegetation cover, and the building’s general appearance, which could significantly impact its value and suitability for purchase.

The decision to buy or sell a property is a significant one, often involving substantial financial commitments. Therefore, the importance of these services cannot be overstated. They provide peace of mind, ensuring that the property in question meets all legal and physical standards, and they help to prevent unwelcome surprises further down the line.

In the upcoming sections, we’ll delve much deeper into the world of conveyancing and survey services, exploring their roles, benefits, potential drawbacks, and their undeniable importance in the real estate industry. Whether you’re a seasoned property mogul or a first-time buyer, stick around for a comprehensive look at these essential services.

Understanding Conveyancing and Survey Services

Before delving into the advantages and disadvantages of these services, let’s first understand what conveyancing and survey services entail and the crucial role they play in property transactions.

Definition and Role of a Conveyancer

A conveyancer is a licensed professional who specializes in property law. Their primary role is to handle all the legal aspects of a property transaction, from preparing essential documents to conducting various searches to ensure there are no hidden issues affecting the property.

Moreover, they also handle contract negotiations, and mortgage arrangements, and ensure that all terms and conditions are fair and legally binding. In essence, a conveyancer’s role is to protect the interests of their client throughout the property transaction process.

Definition and Role of a Surveyor

A surveyor, on the other hand, is an independent expert who assesses all aspects of a property and its surrounding area. They inspect the property to identify any potential issues that might affect its value or habitability, such as structural defects or environmental risks.

Aside from inspecting the physical aspects of the property, surveyors also evaluate its legal aspects. They ensure that the property complies with all building regulations and that there are no outstanding debts or legal issues that could potentially disrupt the sale.

The Difference between Surveying and Conveyancing

While both conveyancing and surveying are essential in property transactions, they serve distinct roles. In simple terms, the main difference between a conveyancer and a surveyor lies in the focus of their work. A conveyancer focuses on the legalities of the property transaction, while a surveyor concentrates on the physical and environmental aspects of the property.

A surveyor performs the initial part of the transaction by assessing the property’s condition and value, while the conveyancer handles the subsequent legal procedures. It’s important to note that these processes often overlap and work in tandem to ensure a smooth and legally compliant property transaction.

By understanding the roles and responsibilities of conveyancers and surveyors, you’re better equipped to navigate the complex world of property transactions. In the following sections, we’ll further explore the pros and cons of conveyancing and survey services.

The Pros of Conveyancing and Survey Services

When it comes to property transactions, the importance of conveyancing and survey services cannot be overstated. These services bring substantial value and benefits, providing you with the assurance and peace of mind you need during one of the most significant financial decisions of your life.

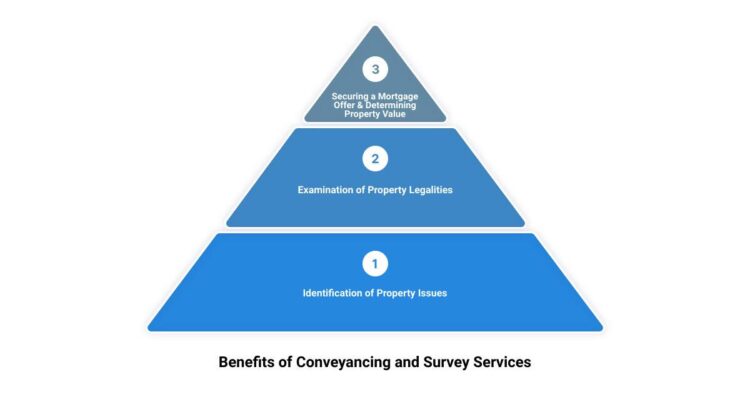

Detailed Examination of Property Legalities by Conveyancers

A conveyancing solicitor meticulously examines the legal aspects of property transactions. They carry out a range of searches, including environmental, bankruptcy, and local authority searches, to ensure that the property you wish to buy is free from any legal issues. They also manage contracts, review title deeds, and negotiate contractual terms on your behalf. This detailed examination is crucial, as it can prevent potential disputes and financial losses down the line.

Identification of Potential Property Issues by Surveyors

Surveyors play a vital role in identifying any potential issues that might affect the property’s value or usability. They conduct a thorough evaluation of the property’s physical and legal descriptions, checking for any changes or defects. They also ensure that the property complies with all building regulations and that it was built according to current building standards. By identifying potential problems early on, surveyors help you to avoid costly surprises after the purchase.

The Role of Conveyancing in Securing a Mortgage Offer

Conveyancing solicitors play a pivotal role in the mortgage application process. In many cases, mortgage lenders require a conveyancer’s services to ensure that the property is legally sound and that there are no issues that might impact its value or their ability to reclaim the loan in case of default. The conveyancer’s report is often essential for securing a mortgage offer, making this service invaluable for property buyers.

The Importance of Surveying in Determining the Property’s Value

Surveyors provide valuable information on the market value of a property. They assess the condition of the land, including the soil structure, vegetation growth, and general appearance, which could impact its value. This service is crucial as it helps you make an informed decision about whether the property is worth buying or selling. Furthermore, a surveyor’s advice on improving your home’s value can increase its resale value when the time comes to sell.

In summary, conveyancing and survey services offer significant advantages. They provide detailed examinations of legalities, identify potential property issues, aid in securing a mortgage offer, and play a crucial role in determining a property’s value. These benefits make these services an integral part of any property transaction.

The Cons of Conveyancing and Survey Services

Despite the critical role they play in property transactions, conveyancing and survey services are not without their drawbacks. It’s essential to weigh these cons against the pros before making a decision.

The Cost of Conveyancing and Survey Services

One of the most apparent downsides of conveyancing and survey services is the cost. Fees can vary greatly depending on the complexity of the transaction, the value of the property, and the expertise of the professionals involved. While some companies offer fixed-fee conveyancing, others may charge on an hourly basis, which can add up quickly if complications arise. It’s important to get a clear understanding of all costs involved upfront to avoid any nasty surprises down the line. You can now reduce the cost by using an online conveyancing service such as My Conveyancing Specialist who will provide an instant online quote which will include all costs

Limitations of Surveyors and Potential Need for Further Investigation

Surveyors play a crucial role in providing detailed information about the condition of a property. However, their inspections have limitations. For instance, they won’t move furniture, lift carpets, or dig up foundations. They rely on visual cues and experience to identify potential issues, which may mean some problems go undetected. If the surveyor’s report flags potential issues, further investigation may be required, potentially incurring additional costs.

Risks Associated with DIY Conveyancing

While DIY conveyancing might seem like a cost-saving strategy, it comes with significant risk. Conveyancing is a complex legal process that requires expert knowledge of property law and an understanding of the specific requirements of mortgage lenders. Mistakes made during the conveyancing process can lead to delays, extra costs, and even jeopardize the entire transaction.

Potential for Discrepancies in Property Valuation by Surveyors

Finally, there’s a potential for discrepancies in the property valuation provided by surveyors. A surveyor’s valuation is based on an assessment of the property at a specific point in time and may not reflect its true market value. If this valuation is lower than the agreed purchase price, it could affect the mortgage offer and complicate the transaction.

While these cons are noteworthy, they underscore the importance of finding reliable, professional conveyancing and survey services. Carefully selected services can help mitigate these risks and ensure a smooth and successful property transaction.

Choosing the Right Conveyancing and Survey Services

Choosing the right conveyancing and survey services is like finding the perfect key to unlock your property dreams. As mentioned earlier, the process can be a minefield of legalities and potential issues that could derail your transaction. To navigate this, you need to carefully consider several factors.

Factors to Consider When Choosing a Conveyancer or Surveyor

When choosing a conveyancer or surveyor, you need to consider their membership and accreditation. It’s essential that they are members of respected professional bodies such as the Law Society of England and Wales, or the Law Society’s Conveyancing Quality Scheme. Don’t hesitate to ask for proof of these memberships.

Cost is another significant factor. Conveyancing and surveying fees can vary widely, with some charging a fixed fee, an hourly rate, or even a percentage of the property price. Always ask for a detailed quote that includes all costs, such as search fees, Land Registry fees, and any other costs related to the process.

Finally, consider their communication methods and customer service. A good conveyancer or surveyor should be able to answer your questions promptly and clearly, making the process less stressful. Check if they have a system for tracking the progress of your purchase, and ask about their availability during key stages of the process.

The Benefits of ‘No-Sale, No-Fee’ or ‘Fixed-Fee’ Conveyancing Services

‘No-sale, no-fee’ or ‘fixed-fee’ conveyancing services offer a level of financial certainty and protection. If the property transaction fails to complete, you’re not left with a hefty bill. However, keep in mind that while the cheapest option may be tempting, overworked, underpaid, and hard-to-reach solicitors could cause more stress than they’re worth.

The Importance of Conveyancer’s Expertise and Availability

The expertise and availability of your conveyancer or surveyor are paramount. A conveyancer with specialist knowledge and experience in property transactions can effectively navigate the legal complexities of the process. Similarly, a surveyor with a keen eye for detail can spot potential property issues that could affect your purchase decision. Being available during key stages of the transaction is also crucial to address any concerns promptly and keep the process moving smoothly.

The Role of Independent Surveys in Providing Peace of Mind

Independent surveys provide an unbiased view of the property’s condition, including its physical features and defects. This can inform your decision and potentially save you from costly surprises down the line. Surveyors provide an independent view of the property, documenting its condition and any potential issues. This can not only help you negotiate a better purchase price but also provide peace of mind knowing that you’re making an informed decision.

In conclusion, the process of choosing the right conveyancing and survey services requires careful consideration of several factors. By doing so, you can ensure a smooth, efficient, and successful property transaction.

Addressing Common Questions about Conveyancing and Survey Services

Navigating the world of property transactions can often feel like deciphering a code. Two terms often confusing are ‘transfer of equity’ and ‘remortgage’. So, let’s break down some of the most common questions to make this journey smoother for you.

Should I do a survey or conveyancing first?

The sequence of these processes can vary depending on the results of your survey. Typically, a property survey is carried out at the beginning of the conveyancing process, and completion is the last step. If you’re satisfied with your survey results and conveyancing searches, then you can confidently exchange contracts and complete them.

Do I need a conveyancer and a surveyor?

Yes, you do. Both conveyancers and surveyors play essential roles in the property-buying process. Conveyancers handle the legal aspect of the property transaction, studying the draft contract in detail and highlighting any areas requiring further investigation, such as whether a property is leasehold or freehold. On the other hand, surveyors carry out essential inspections of the property, providing key information about its condition.

What are the benefits of conveyancing?

Conveyancing solicitors ensure that all legal requirements are met during a property transaction. They study the draft contract in detail, verify the property’s legality, and identify potential issues that might affect the transaction. For instance, they can check whether a property is leasehold or freehold. This meticulous examination ensures that you’re aware of all potential issues before finalizing the purchase, thereby saving you from future legal problems.

What is the difference between surveying and conveyancing?

The main difference between a conveyancer and a surveyor lies in their roles. A surveyor performs the first part of the property transaction process, conducting detailed surveys for the marking of boundaries and easements. Meanwhile, the conveyancer handles the rest of the paperwork and transaction, ensuring that all legal requirements are met. Despite these differences, both roles are crucial to a successful property purchase.

By understanding these essential aspects of conveyancing and survey services, you can make informed decisions during your property purchase journey. Remember, both conveyancers and surveyors play pivotal roles in ensuring a smooth and hassle-free property transaction.

Conclusion

As we draw the curtain on our exploration of conveyancing and survey services, we reflect on the key takeaways. The pros and cons of these services offer valuable insights into the intricacies of the property buying process. It’s clear that both conveyancing and survey services provide a bedrock of legal and technical expertise that is critical to any successful real estate transaction.

Conveyancing, the legal process of transferring property from one owner to another, offers numerous benefits. It involves a thorough examination of property legalities, ensuring that any potential pitfalls are addressed before the sale proceeds. The role of conveyancing in securing a mortgage offer is also pivotal. However, the costs associated with these services and the potential risks of DIY conveyancing are notable cons.

On the other hand, survey services provide an essential evaluation of the property’s condition and value. A surveyor’s expertise can identify potential issues that could impact the property’s value or require costly repairs in the future. Yet, there are limitations, such as the potential need for further investigation and possible discrepancies in property valuation.

In the vast sea of real estate transactions, the importance of these services cannot be overstated. They act as navigational beacons, guiding you through the complexities of the process. By choosing the right conveyancing and survey services, you can ensure that you’re not sailing blind in the turbulent waters of property buying.

As we conclude, it’s clear that the journey of property purchase might seem daunting, but with the right conveyancing solicitor and surveyor by your side, it can be an exciting, fulfilling, and stress-free adventure.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024